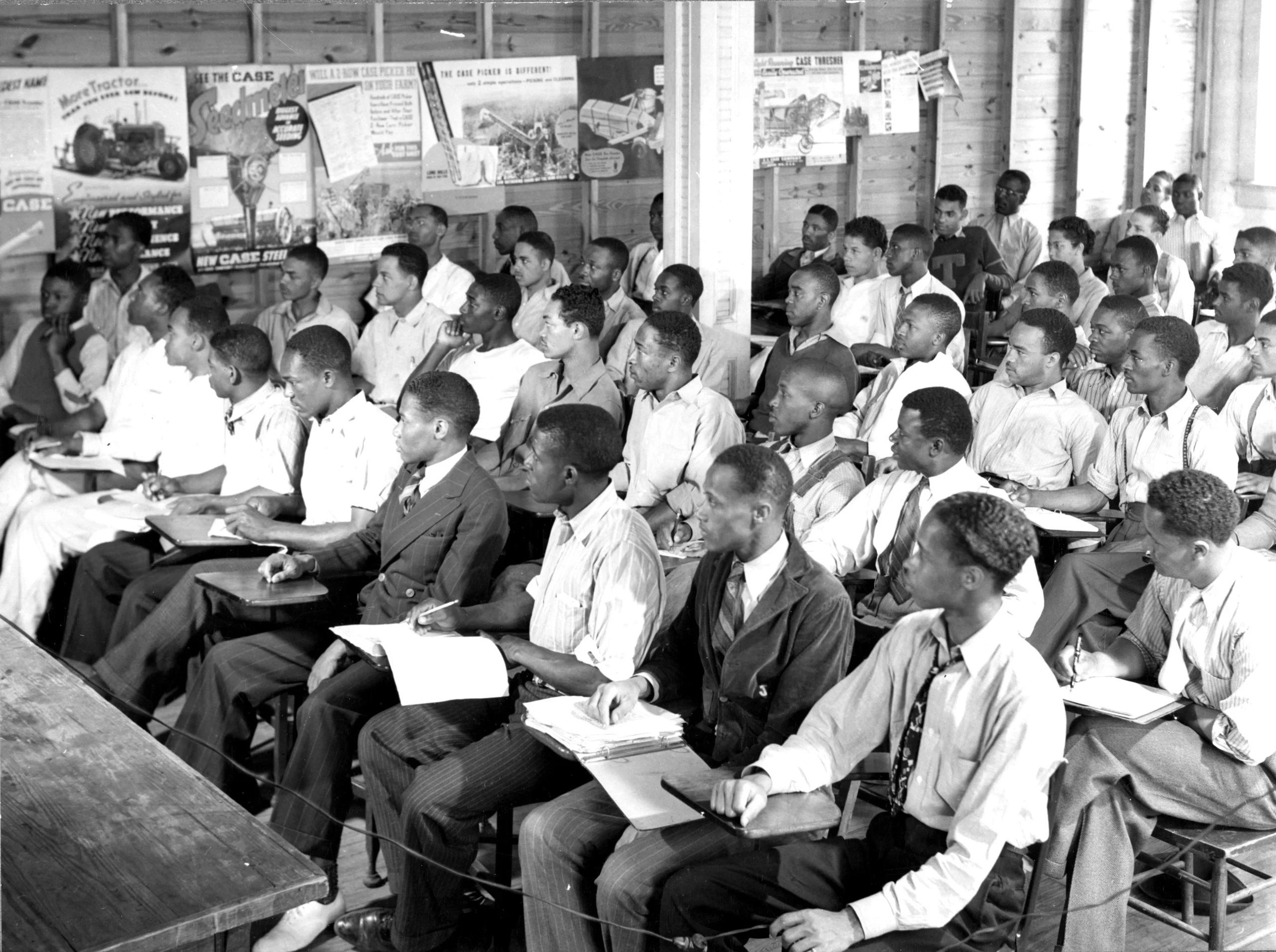

Decades of segregation & under-representation have led to

countless gaps in access, equity, and opportunity.

The economic power of the minority community here in the US is staggering at over $5T spent annually – e.g., Latinx / Hispanic Americans ($1.9T), African Americans ($1.7T), Asian Americans ($1.3T), and Native / Indigenous Americans ($123B). The direct impact of minority-owned businesses is over $140B annually with over 700K jobs, with an indirect impact of $116B and an induced impact of $145B. The annual economic impact of Historically Black Colleges and University (HBCU) graduates is $15B, with an employment impact of 134K jobs and total lifetime earnings of $130B.

While these numbers are difficult to deny, investment and capital remain elusive within communities of color. HBCUs and other Minority Serving Institutions (MSIs) receive a fractional percentage of research and investment funding. Additionally, minority founders receive on average 1% of investment funding compared with their majority counterparts.

Historical Disparities

Decades of racial segregation in education and economic opportunities have created deep-rooted disparities, limiting access and upward mobility for communities of color.

Limited Access to Capital

Historically, communities of color have faced barriers in accessing capital and investment, limiting their ability to start and grow businesses.

Lack of Representation

The underrepresentation of minority voices and perspectives in innovation and entrepreneurship fields has perpetuated disparities in opportunities and innovation.

The Digital Divide

The digital divide has widened disparities in the modern age, with many underserved communities lacking access to essential technology and digital skills.

Limited Entrepreneurship

Historically, communities of color have faced challenges in accessing entrepreneurship resources and support, stifling their potential for economic self-sufficiency.

Role of HBCUs / MSIs

These institutions have historically received disproportionately lower funding compared to PWIs, hindering their ability to provide quality education, research, and commercialization opportunities.

Market Disparities

Overall, HBCU innovation & entrepreneurship centers as a whole are inconsistently operated and funded with uneven industry & technology partnerships.

Market Disparities – Innovation

- Intellectual Property Ownership: Historically Black College and University (HBCU) students typically account for less than 1% of total patents granted in the United States.

2. Research Funding: HBCUs receive a smaller share of research funding, impacting opportunities for intellectual property development and technology transfer.

3. Startup Incubators: Many Predominantly White Institutions (PWIs) offer a significantly higher number of startup incubators compared to HBCUs.

4. Accelerator Programs: Participation rates in renowned accelerator programs are lower for HBCU students.

5. Funding and Investment: Startups linked to PWIs often secure larger funding rounds, sometimes orders of magnitude greater than those associated with HBCUs.

6. Venture Capital Investment: Startups associated with HBCUs receive a significantly smaller percentage of venture capital funding, often in single digits.

7. Startup Creation: Students at PWIs create a larger number of startups, sometimes several times more than HBCU students.

8. Technology Transfer Agreements: Technology transfer offices at PWIs often manage a higher volume of agreements compared to those at HBCUs.

Market Disparities – Capital Investment

- Venture Capital Funding: In 2020, Black founders received just 1% of total venture capital funding, Hispanic founders received 2%, and Indigenous founders received less than 0.2%.

2. Startup Funding: Startups led by minority founders receive significantly less seed funding compared to startups led by White founders.

3. Angel Investment: Minority entrepreneurs receive a lower percentage of angel investments, which are crucial for early-stage startups.

4. Bank Loans: Minority-owned businesses are less likely to receive approval for bank loans and often face higher interest rates.

5. Crowdfunding: Crowdfunding campaigns led by minority entrepreneurs often raise less money compared to those led by White entrepreneurs.

6. Investment Size: Startups led by minority founders receive smaller investments, which can limit their growth potential.

7. Valuation: Minority-led startups often have lower valuations, affecting their ability to secure favorable funding terms.

8. Startup Success Rates: Disparities in access to capital contribute to lower success rates among minority-led startups.

9. Representation: Minorities are underrepresented in venture capital firms, influencing funding decisions.

10. Investor Bias: Unconscious biases among investors influence funding decisions, disadvantaging minority entrepreneurs.

HBCU Entrepreneurship Programs

- 93% have an option for undergraduates to major in business.

2. 75% offer entrepreneurship courses.

3. 38% offer a Master of Business Administration.

4. 72% have opportunities for students/alumni to build networks on entrepreneurship and business issues.

5. 47% have opportunities for local entrepreneurs and business owners to build networks.

6. 57% offer technical assistance to entrepreneurs.

7. 6% have programs to directly provide seed funding for startups.

8. 27% have programs that help entrepreneurs find external funding.

Bridging the Gaps